This article applies to U.S customers only. For Canada customers, please reference this article.

IMPORTANT: Keap negotiated with WePay to delay shutting down their payment processing until May 1, 2024. We are using this extra time to conduct more testing so that your upgrade to Keap Pay is easy and smooth. We are opening Keap Pay to WePay customers on March 4th.

What’s Happening?

Chase, the parent company of WePay, informed Keap that they are shutting down WePay operations in 2024. Starting May 1, 2024, Keap customers will no longer be able to process payments using WePay.

To allow for uninterrupted payment processing, we’re excited to provide exclusive early access to Keap Pay. Keap Pay represents the future of payments at Keap that will bring enhanced support and functionality to your business automation within Keap.

To minimize the burden of a data migration, your WePay account details including all current payment and invoice data, have already been migrated to Keap Pay. On Mar 4, 2024, you will be asked to review and confirm your account data to complete the transition and ensure continuous processing.

General FAQs

Who is impacted by the WePay closure?

WePay is only available to Keap customers in the U.S. and Canada so it is customers in these regions who are currently using WePay as their payment processor that are impacted by WePay's closure. WePay’s closure will not impact other international customers, and we don’t have plans to shut down any international integrations at this time. We’ll be working diligently to open Keap Pay up to international customers soon.

Will I be able to issue refunds after WePay closes?

Refunds will need to be processed through the WePay Merchant Center. They will not process via Keap because WePay no longer receives any information sent to them through Keaps API.

WePay has explained that merchants will have access to the WePay Merchant Center for 180 days post termination.

You have 60 days to issue a refund after the initial transaction. If you are trying to issue a refund beyond the 60 day pay window, you must contact WePay's Customer Delight at [email protected] to request assistance with issue the refund.

What will happen to my credit card data?

Your credit card data is being securely stored and no action is required to transfer your data to Keap Pay.

Is there a charge for this migration?

There is no charge for the migration to Keap Pay.

Will my processing rates change?

Your credit card rates will not change. You can continue to expect the same rates for your payment processing needs.

When will this happen?

Migration from WePay to Keap Pay will begin March 2024 after the completion of our Beta cycle. We will send more information about it along with instructions to get started in early March 2024.

What are the next steps?

Nothing is required at this time. In March, you will receive instructions on how to confirm your account setup prior to the migration to Keap Pay.

What additional benefits can I expect with Keap Pay?

We understand that money movement is incredibly important to our customers and as a result we are investing heavily in payment features and functionality. Keap Pay will remove the frustrating back and forth customers experience today with outside processors and allow us to deepen the connectivity between money movements and the Keap features you already know and love today.

Additionally, we’ll be releasing new functionality including ACH and Apple Pay plus enhanced deposit and payment metric reporting.

Who will have access to Keap Pay?

Keap Pay will be exclusively available to US WePay customers at this time. WePay customers in Canada will receive direct communication regarding steps required to continue processing through Keap. Canada will be supported in time for our official release in mid 2024.

How will it impact my Keap account?

For Classic/Ultimate customers:

Certain payment features can be set to either the default payment processor in your Keap account or connected to a specific processor. We recommend reviewing the following to see if they are connected to WePay. Those should be connected either to the default processor or specifically to Keap Pay.

- Order Forms

- Payment Plans

- Shopping Carts

- Existing Subscriptions

- Any Open Invoices

Pro/Max Customers:

Keap customers using Pro/Max will need to navigate to the Payment Processing page in the Sales Settings and ensure that Keap Pay is set as the default.

Can I use Keap Pay if I’m not a WePay customer today?

Unfortunately, Keap Pay is only available to WePay customers at this time. If you’re interested in Keap Pay, sign up here to join our waitlist and we’ll let you know when we open enrollment.

Starting March 4, 2024 - Enrollment Instructions

If you use Keap Max Classic, your Keap app must be toggled to the new Keap Ultimate interface in order to migrate to and use Keap Pay.

Keap Pro/Max users do not have to make any changes to their user interface.

Gather the necessary information

We recommend having this information on hand to make the process as smooth as possible.

- Business Tax ID

- Your Social Security Number

- Bank account number for deposits

- Validation of business ownership (e.g. voided check, or other proof

Verify and submit account information for review

- Log into your Keap app https://signin.infusionsoft.com/

- Navigate to the payment processing page

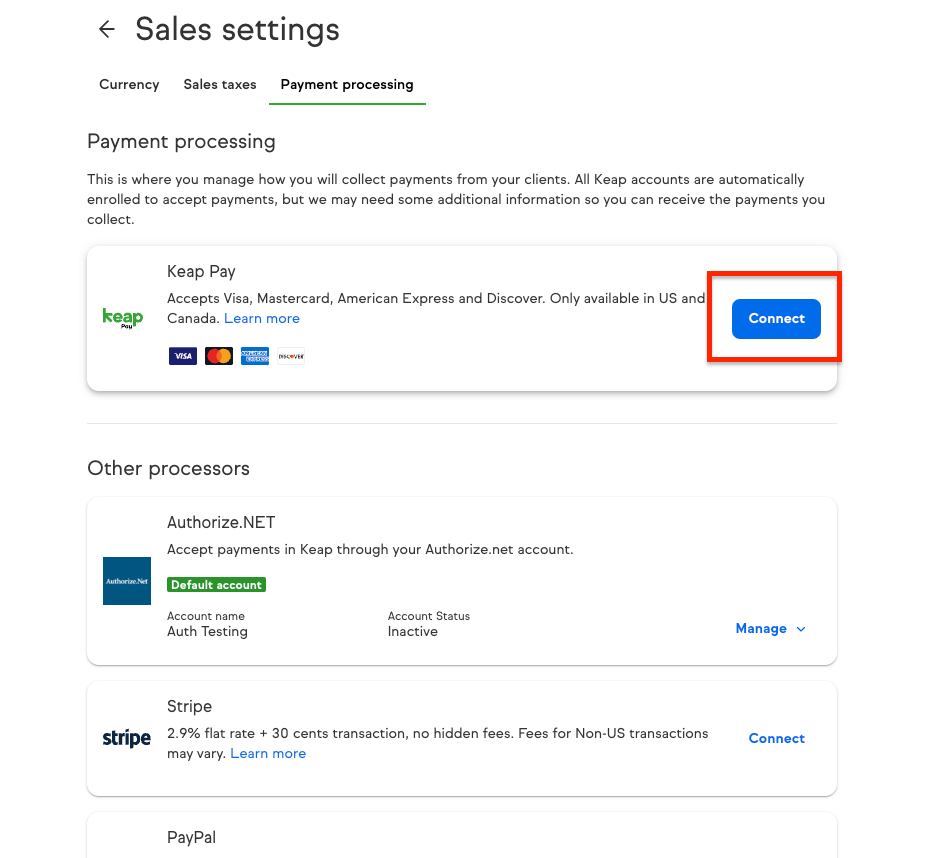

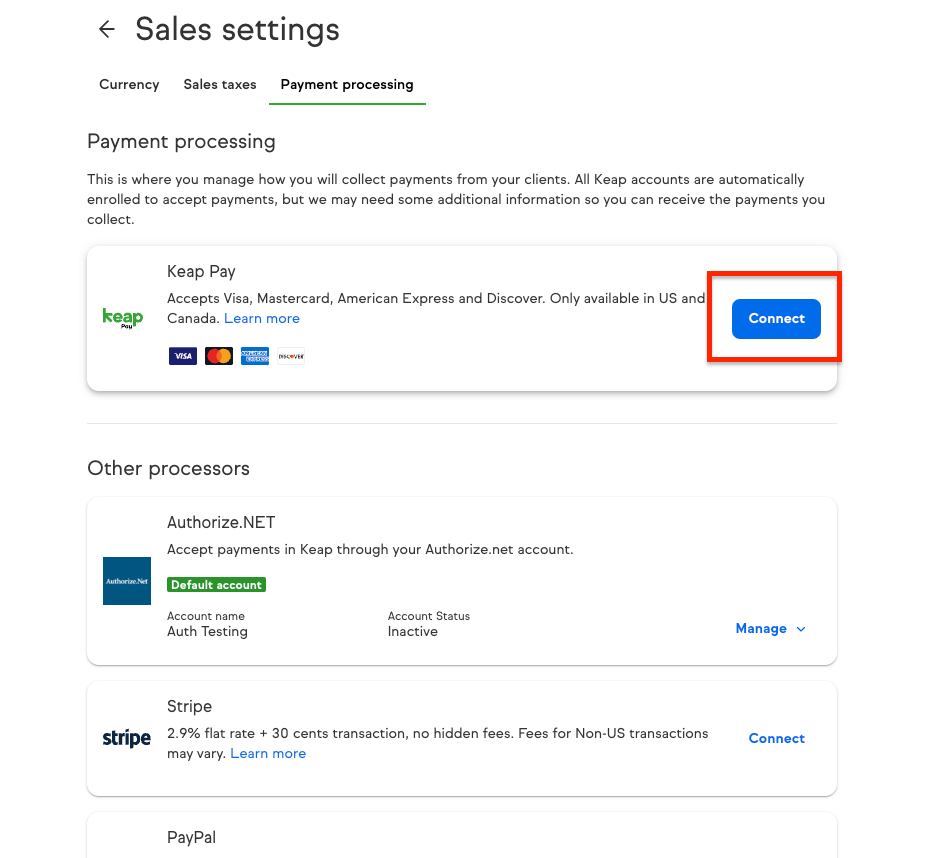

Locate Keap Pay card and click ‘Connect’

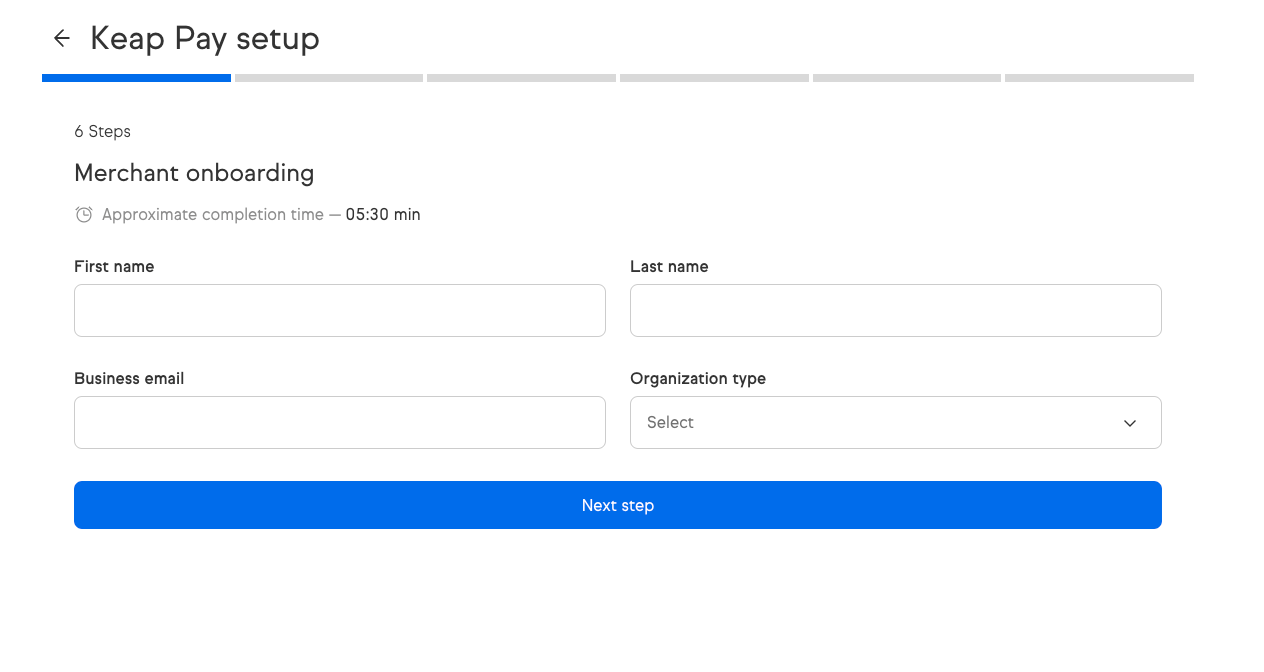

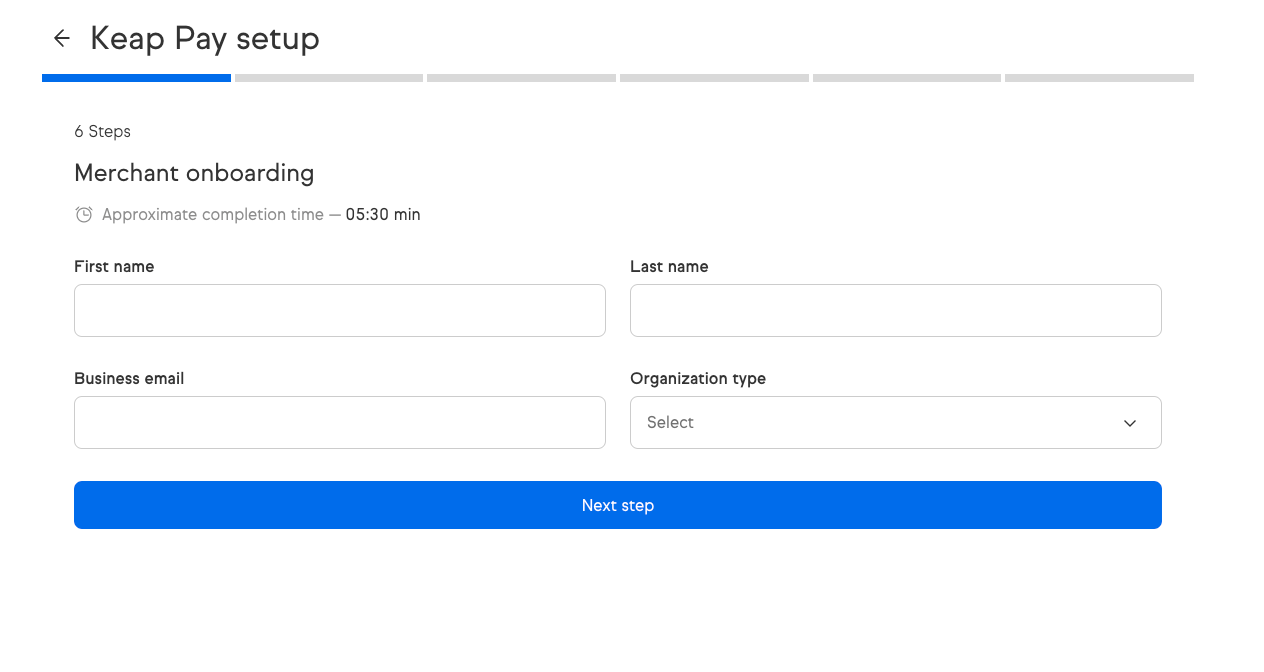

Review account information to verify accuracy. Fill in fields as necessary.

Submit your account information

What happens during migration

- Customer Action: You click “Connect” on the Keap Pay box

- Keap Process: The Keap customer is created as a new merchant in Keap Pay

- Customer Action: Complete the Keap Pay set up and click “Submit”

- Wait at least 48 hours to be activated with Keap Pay.

- Keap Process: Keap starts migrating all cards that are active and tokenized in Keap Pay

- Keap Process: Keap customers is activated for Keap Pay

- Was WePay your default payment processor before migration?

- If yes - Keap Process: Default processor is changed to Keap Pay

- If no - Customer Action: You must manually change default processor to Keap Pay

- Keap Process: Order forms, subscriptions, Payment Plans and Autocharges will transfer to Keap Pay

- Keap Process: Access to add new credit cards will be blocked for WePay

- Credit card data migration is complete.

Migration FAQs

What information is being migrated automatically?

Your customers' credit card info is being migrated to Keap Pay from WePay.

Is my banking information being migrated over as well?

Your banking information is not being copied over. You will need to enter that information along with your Tax ID number(s) to complete the Keap Pay setup.

What involvement will I have in this data migration?

Completing the Keap Pay setup requires your action to fill out the Keap Pay forms in your Keap app.

Will my customers see any changes in the timing of their payments?

The timing of your payments will not change because the schedule for subscriptions, recurring payments, etc are managed within Keap itself.

Will my customers see any changes in name of the payments in their bank statements?

Your customers will see a small change in their bank statements. With WePay your transactions probably show up as something like WP YourBusinessName. With Keap Pay that will change to RF*YourBusinessName.

Can I use Keap Pay if I’m not a WePay customer today?

Unfortunately, Keap Pay is only available to WePay customers at this time. If you’re interested in Keap Pay, sign up here to join our waitlist and we’ll let you know when we open enrollment.

What if I use multiple payment processors today? Will I be able to migrate my payments from those processors to Keap Pay at this time?

Only WePay is affected at this time. If you are using another processor today, there is no change to your payment processing through those merchant accounts.

What if I don’t want to use Keap Pay?

You’re welcome to select another one of Keap’s integrated payment processors. Please note that you will be responsible for initiating and managing the migration between WePay and the new processor. WePay’s process is detailed below.

How will I migrate my credit card data from WePay a different processor

- Ensure you have an account (or create one) with your new processor.

- Send an email to [email protected] to request the migration of your credit card data with the following information:

- The business name of the other processor

- The name and email address for your point of contact at the other processor

- The name and email address for your point of contact at Keap.

- Keap Payments Team

- [email protected]

- You can alternatively fill out WePay’s export request Google Form here. Their documentation reports that “A representative of our migration team will vet your request and follow up within 2-3 business days.”

WePay’s full export documentation can be found by clicking here.