Keap Pay is Keap’s very own payment solution that helps businesses streamline the payment experience for their customers, obtain clearer financial business insights and follow the entire customer journey directly within their Keap App. Plus, with Keap Pay’s concierge support, businesses will be able to handle all of their payment needs directly with Keap. No more logging in and out of different software to piece together your customer journey.

Payment Methods

Keap Pay will be able to accept the following payment methods

Major debit and credit cards (Visa, Mastercard, American Express, and Discover)

Once you are active with Keap Pay you can accept payment through any of Keap’s E-commerce features (Order Forms, Shopping Cart, Invoices, Manual Payments)

*NOTE to current Ultimate Users who have previously set up Order Forms or Shopping Cart to avoid breaking any previous code you have used to create a theme, any/all themes created prior to April 2023 will not be able to accept payments via Keap Pay and will need to be updated with a newly created theme. Click here to learn more*

Payment Dashboard

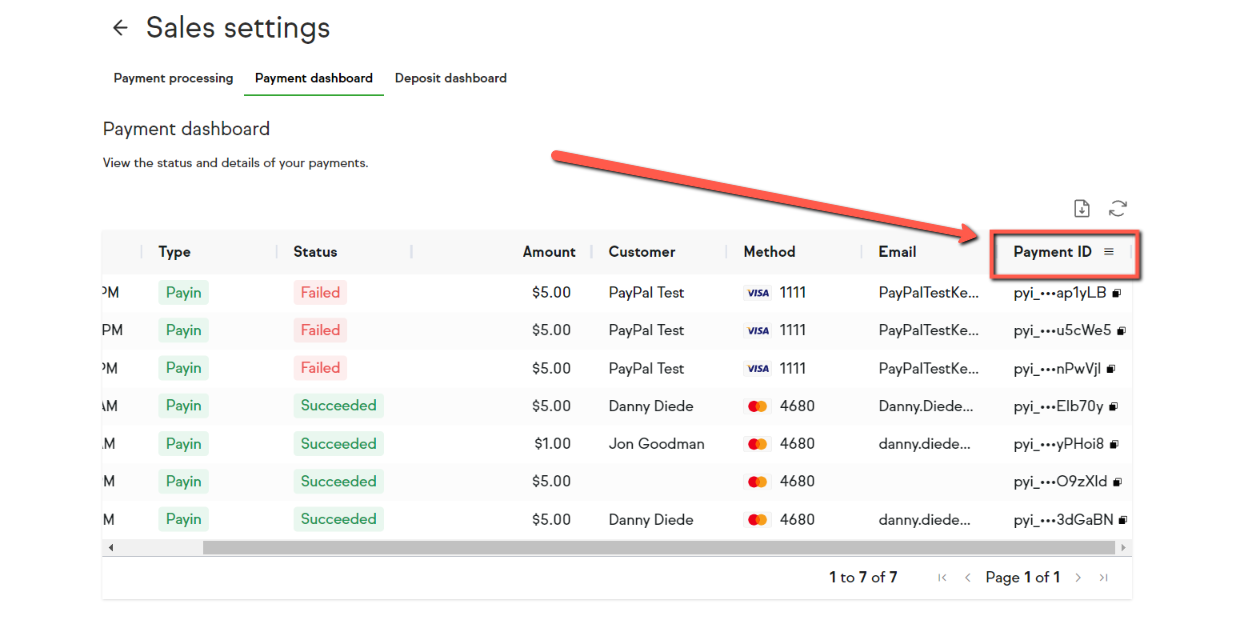

Keap Pay’s Payment Dashboard will allow you to see the status of your incoming payments in real time along with transaction or payment IDs if support help is required.

NOTE: Keap Pay dashboards are only available in Keap Pro/Max and Keap Ultimate. If you're currently using the Keap Max Classic interface, you must toggle to Keap Ultimate in order to access the dashboards.

Navigating the payments dashboard

Accessing the payments dashboard

Navigate to Sales

Under Related Shortcuts, you will see Payment Dashboard

Items on the Dashboard:

Date the Transaction was created

Payment Amount

Customer Name

Payment Method (Credit Card type with Last 4)

Customer Email

Payment ID

IMPORTANT: The Customer Name and Email are from the billing information entered when the payment method was originally charged.

Finding a Specific Payment

To find the transaction for a specific payment,

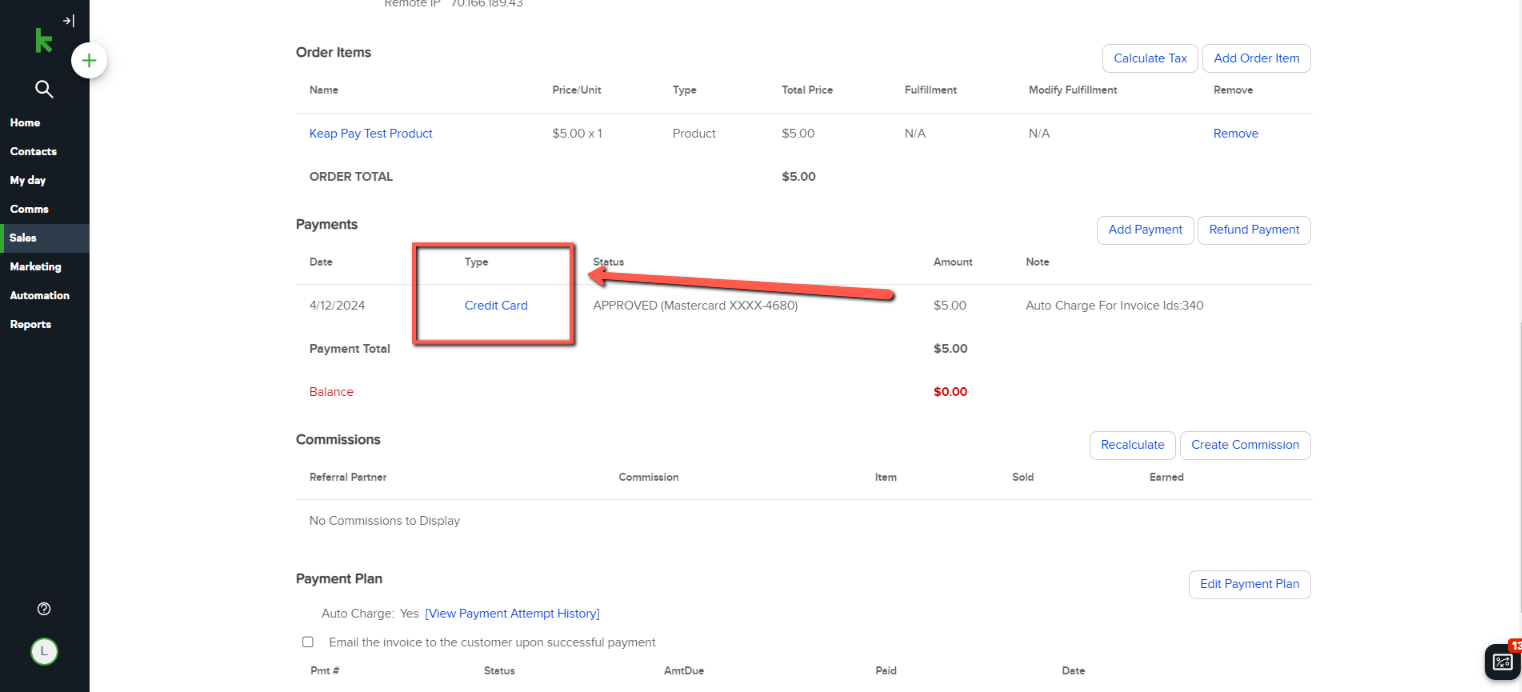

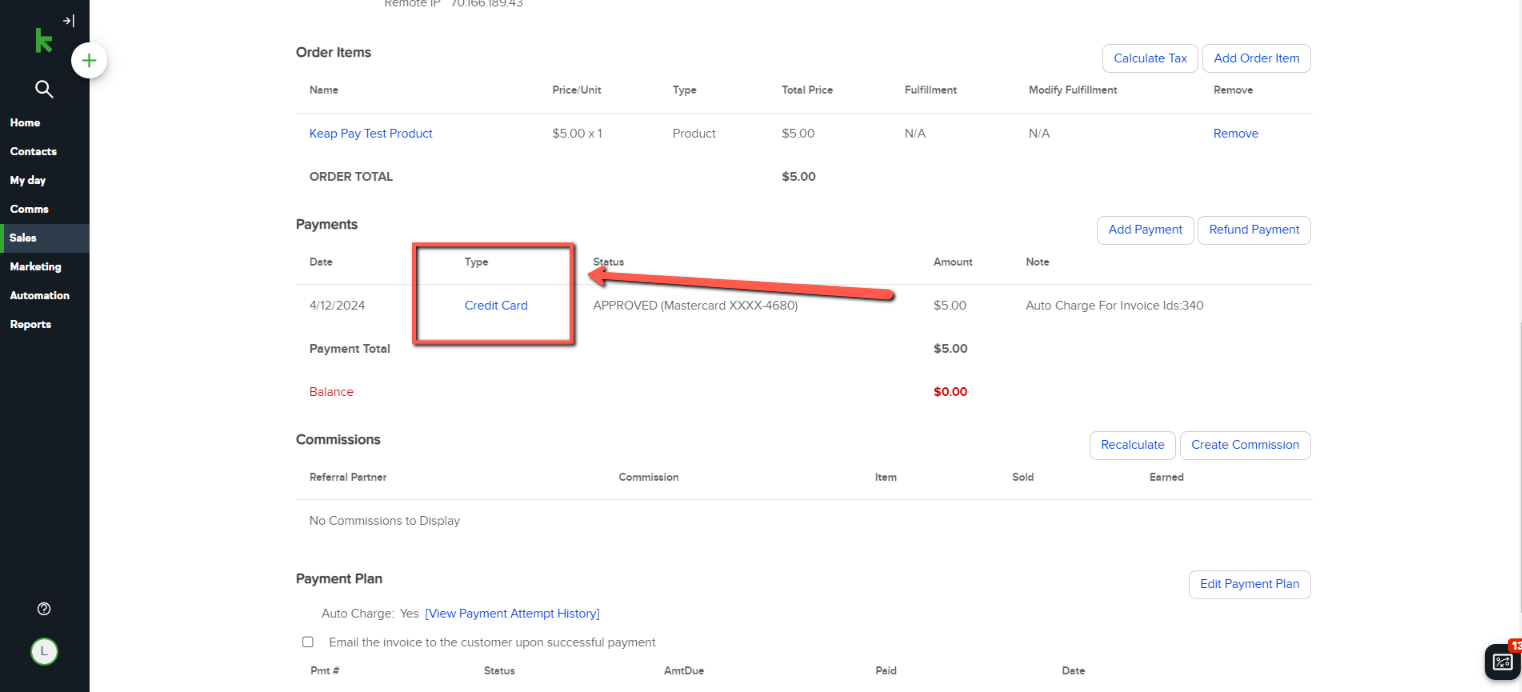

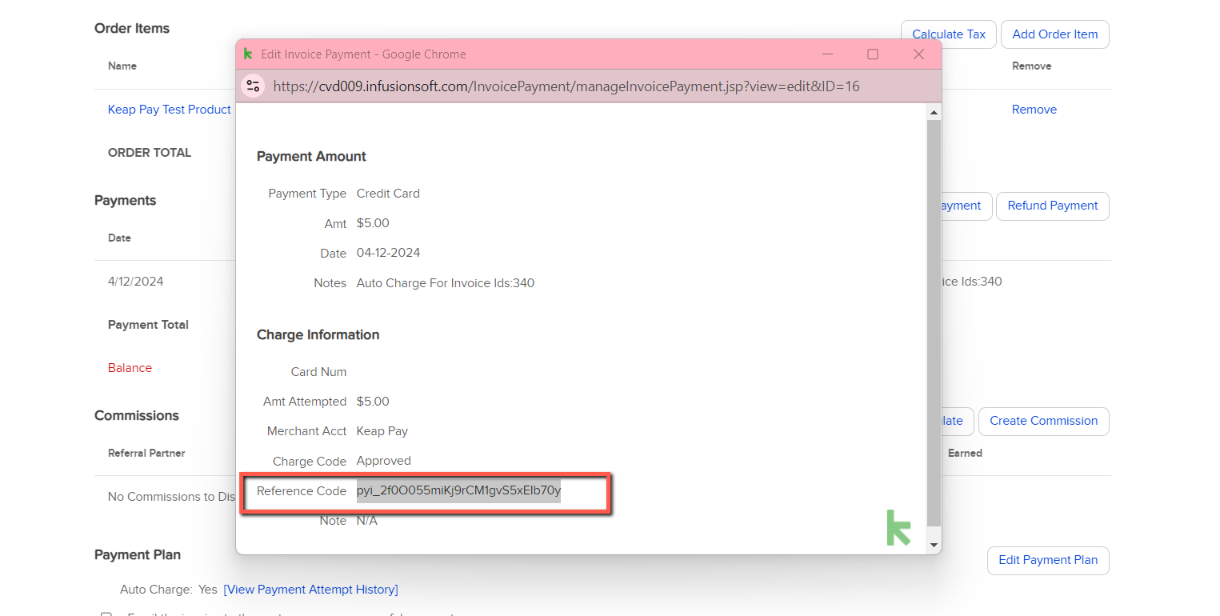

- Open the order containing the payment and under the "Payments" section, click the blue hyperlinked text under the "Type" column

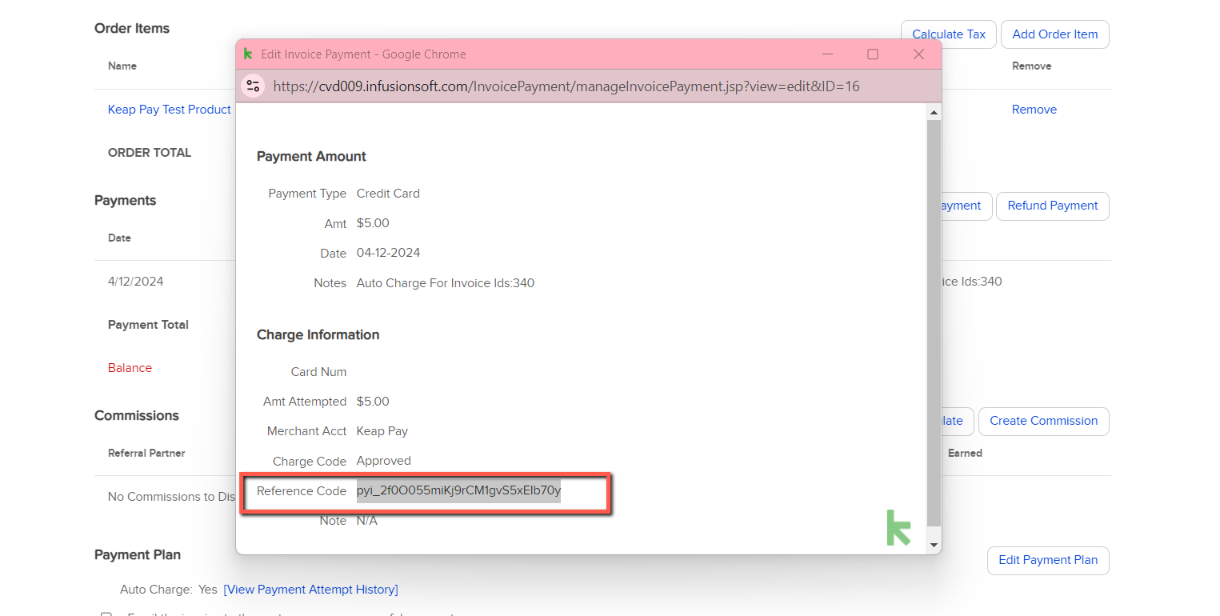

- In the pop-up window copy the Payment ID to the right of the "Reference Code"

*Note:The Payment ID is critical for our Support team when reaching out for to narrow down which payment you are looking for help on.*

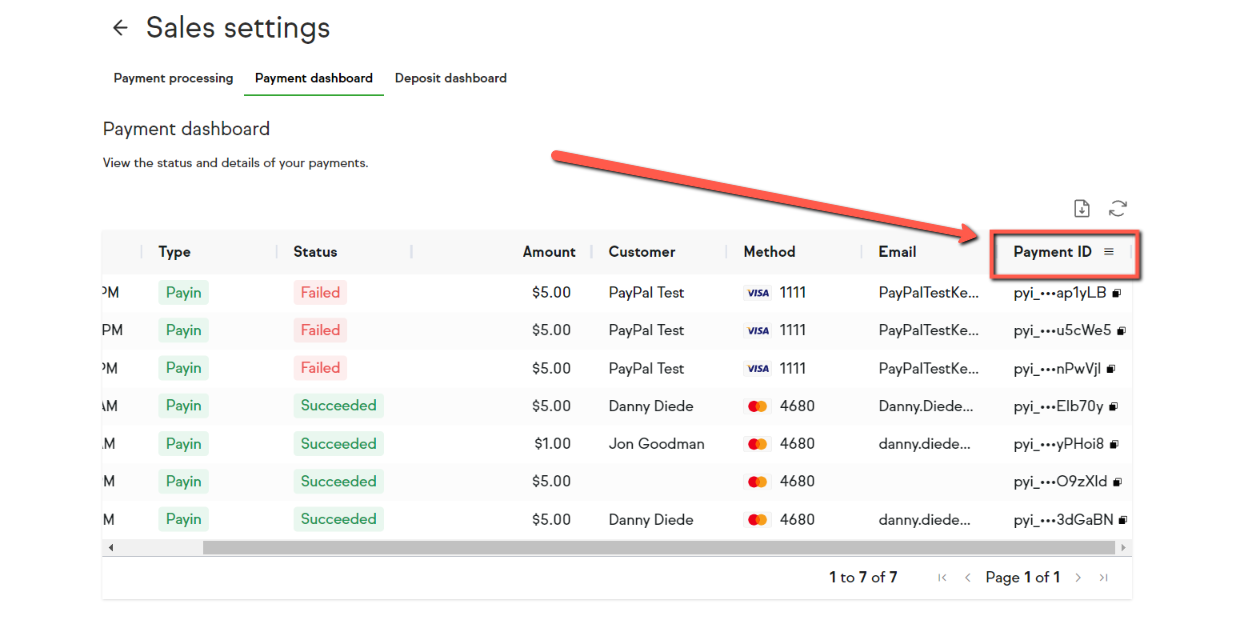

- Go to the payments dashboard, hover over the"Payment ID" column and click the three lines

- Paste in the payin ID and click apply, this will filter the payments dashboard to show that specific transaction

Another method of searching for the payment is by

Sorting by the date the transaction occurred

Searching by the amount of the payment

*NOTE not all payments will have a name recorded, however the Contact ID as well as the Invoice ID are correct*

Clicked into the Payment Details

Investigating a Payment Decline

Payments can decline for many reasons, however, the payments dashboard will give you additional insight into the reason for the decline. This reason will help you decide how to recover the funds that failed to process

1. Navigate to the payments dashboard by going to Sales > Keap Pay > Payments Dashboard

2. Filter by either the Contacts name or Email to find the failed payment, then apply the filter

*Note - if you're having issues locating the failure, filter by the date the payment failed using the "Created Date" column*

3. Once you have located the failed payment, click on the payment itself to pull up the payment details

4. Check the "Refusal Reason" and "Detailed Refusal Reason" codes, these codes will give you the insight needed to recover the funds that failed to process

*For more information on these codes, please see the Failed Payment Refusal Codes*

Exporting transactions from the Payments Dashboard

When on the Payments Dashboard, click on the icon in the top right-hand corner and a pop-up will appear. In the pop up you can export transactions from the previous month, current month, or over a custom period of time. Once the date range has been set, click the "Export" button to download the report as a CSV file.

Please note that any filters applied to the payments dashboard when exporting will be applied and when using a custom time period filter, you can export up to 31 days worth of data at a time.

*i.e. exporting the payments dashboard between 7/01/2024 to 8/01/2024 will work, but 7/01/20024 to 8/02/2024 will not.*

Sticker Pricing

| Card Processing Fees - Applies to all credit card payments and refunds |

| Card Transaction Volume Fee | 2.99% |

| Card Transaction Per item Fee | $0.30 |

| Payout (Deposit) Fees |

| Standard ACH Payout (Per batch) | $0.15 |

| Additional Fees |

| Card Refund | $0.30 |

| Chargeback (Card or ACH Dispute) | $15.00 |

Payment Types

Payin - Your client made a payment with you

Refund - You have initiated a partial or full refund

Adjustment - You have adjusted the total owed

Chargeback - This Payment has had a Chargeback initiated on it

Payment Statuses

Processing - Payment was successful and is currently pending completion

Succeeded - Payment has completed processing and is available for deposit

Failed - Payment Failed to Process (Refusal codes below)

In Review - This payment has been flagged for risk review

Canceled - The payment was canceled and no funds will move

Presenting - Space between card being shown and actually processing

Fraud Protection with Keap Pay

Keap Pay leverages AI powered third-party tool that performs real time monitoring at checkout. By leveraging the tools below, in addition to other fields, Keap Pay ensures that fraud protection strategies are optimized for your payment processing needs.

Velocity and Small Ticket Testing – to prevent card testing

Large Ticket Monitoring – reduce chargeback risk

VPN blockers – ensure device and billing country are the same

Black List Monitoring – IP Addresses, email, card number, and more

Sanctioned Country Monitoring – IP address screening

Identity Verification – Age of email, matching addresses, IP adress, and more

Keap App specific data – Contact ID, Order ID, Invoice ID, App ID, and more

Dynamic Prevention Criteria – Updates as transactions are monitored

How fraudulent transactions are handled with Keap Pay

Keap Pay and it's backend fraud partners aim to decline as few transactions as possible to ensure while still protecting customers from fraud attacks. While the vast majority of transactions are declined by the card issuing bank due insufficient funds or suspected fraud, our fraud tool will occasionally trigger a decline during authorization (before the transaction ever reaches the card network or issuing bank). This level of security during authentication protects against card testing and other forms of fraud attacks. You also are able to get insights into why transactions were declined via the payments dashboard.

Below is a list of decline codes that you would see in this report

Failed Payment Refusal Codes

| CODE | DESCRIPTION | Recommended Cardholder Action |

| DECLINED | Declined. | Issuer Decline - Call Bank or Try Alternative Payment Method |

| DO_NOT_HONOR | Do not honor. | Issuer Decline - Call Bank or Try Alternative Payment Method |

| EXPIRED_CARD | Expired card. | Issuer Decline - Call Bank or Try Alternative Payment Method |

| FRAUDULENT_CARD | Fraudulent card. | Issuer Decline - Call Bank or Try Alternative Payment Method |

| INCORRECT_PAYMENT_INFORMATION | Incorrect payment information. | Review Billing and Card Information |

| INSUFFICIENT_FUNDS | Insufficient funds. | Issuer Decline - Call Bank or Try Alternative Payment Method |

| INVALID_CARD_SECURITY_CODE | Invalid card security code. | Review Billing and Card Information |

| INVALID_EXPIRATION_DATE | Invalid expiration date. | Review Billing and Card Information |

| INVALID_PIN | Invalid PIN. | Review Billing and Card Information |

| LOST_CARD | Lost card. | Issuer Decline - Call Bank or Try Alternative Payment Method |

| NO_CARD_NUMBER_ON_FILE_WITH_ISSUER | No card number on file with issuer. | Review Billing and Card Information |

| NO_SUCH_CARD_ISSUER | No such card issuer. | Review Billing and Card Information |

| OVER_LIMIT | Over limit. | Issuer Decline - Call Bank |

| PROCESSING_ERROR | Processing error. | Re-Try Payment |

| RISK_DECLINE | Fraud Tool Triggered Decline | Try Alternative payment Method |

| STOLEN_CARD | Stolen card. | Issuer Decline - Call Bank or Try Alternative Payment Method |

| UNEXPECTED_PAYIN_TOKEN | Unexpected payin token. | Re-Try Payment |

| UNSUPPORTED_CARD_TYPE | Unsupported card type. | Try Alternative Payment Method |

AVS Response Codes

A: Address matches, ZIP code does not match

Z: ZIP code matches, address does not match

Y: Both address and ZIP code match

N: Neither address nor ZIP code match

For a full list of all the possible AVS Response codes, click here.

CVV Response Codes

M: CVV matches

N: CVV does not match

P: CVV was not processed

S: CVV should be on the card but was not provided

For a full list of all the possible CVV/ CVC Response codes, click here.

FAQ’s

Q - Are there any businesses that are prohibited from using Keap Pay?

A - Yes there are some business types that we prohibit from using Keap Pay. Many of these business types are also against our AUP. Here is a comprehensive list of our prohibited businesses for Keap Pay. If you see your business type on this list but you are allowed to send email via Keap please contact support to see if we can make an exception.

Q - I want to use Keap Pay but I’m looking for a lower rate than what's posted?

A - With Keap Pay we may have some flexibility in our pricing depending on a few factors. If you would like to review please contact your CSM or the payments team using [email protected].

Q - I filled out my Onboarding Form but I’m still not active yet and heard nothing.

A - It can take up to 3 business days for onboarding to complete. Your application may require additional documents or information required for verification, please check your email to see if you received communication from the Payments team using [email protected]. If 3 business days have passed and you have not received an email, please contact support.

Q - When will my payments show up in my bank account?

Deposits are made from the date of the Transaction plus 1 business day for all Card Transactions. This will be impacted by bank holidays and weekends.

| Card Transactions - 11PM ET Cutoff |

| Day of Transaction | Day of Deposit |

| Monday | Tuesday |

| Tuesday | Wednesday |

| Wednesday | Thursday |

| Thursday | Friday |

| Friday | Monday |

| Saturday | Monday |

| Sunday | Monday |

Q - What does the transaction read on my clients bank statements?

A - When you apply for Keap Pay you are required to provide a DBA (Doing Business As). When a client makes a transaction through Keap Pay, their bank account will read RF*DBAName.

Q - My Customer made a transaction but its not showing on the Payment Dashboard

A - First, take a look at the order and check what payment processor was used. You can do this by clicking on the blue hyperlinked text that reads “Credit Card” in the “Payments” section of the order. The popup window will say the merchant account that was used for that Credit Card charge. If it says “Keap Pay” and it has been longer than 1 hour since completing the transaction please contact support.

Q - How do I process refunds?

A - We will soon be adding the ability to refund right within the Payment Detail on the Payment Dashboard. For now please refer to the current refunding options discussed in these Help Center Articles.

Q - I see I got a Payment but I’m not seeing it on my Deposit Dashboard

A - First make sure the payment is in the “succeeded” status. Then check the date of the transaction and compare it to the deposit timing. If it's been past that time and it's showing the “succeeded” status, please contact support.

Q - How do I update the Business Information for my Keap Pay Account

A - If there is a change in your business ownership, name, address, or tax IDs please reach out to the payments team right away using [email protected] and we can get those updates done for you.

*NOTE updating your business information may require a new application to be submitted, this depends on the information needing to be updated.*