Keap Pay is a fully embedded Payments Option owned and sponsored by Keap. By using Keap Pay you will always have access to the most up to date technology we have to offer as well as our world class support. You will be able to see all your payments running through Keap in real time and see those payments turn into deposits right from your application.

Set up Keap Pay

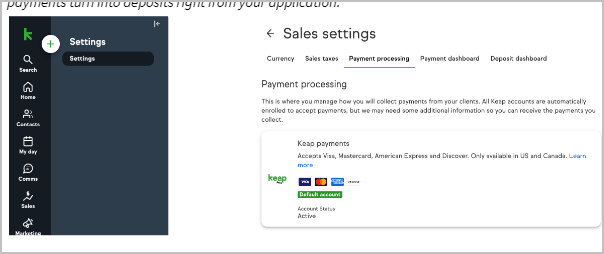

- Navigate to the Payment Processing Page via Sales Settings

Click Connect on Keap Pay section: sign Up Flow will open up

Information on file will automatically populate these fields, please validate the information is correct and fill in what’s missing (this should take no more than about 5 minutes).

Check the Terms and Conditions Box and click Submit

Acceptance can take anywhere from a few minutes up to 72 business hours. You will see your Keap Pay status switch to pending until you are activated.

- You may receive an email from [email protected] after you sign up looking for more information to get you activated. If so please connect with us so we can help. (For more information on what and why we would need additional info check out our article on Beneficial Owner Data Requirements (Need Link) (Coming Soon)

- If it has been over 72 business hours and you have not seen a change in your status nor received any update from the Payments team please contact support.

Accept Payments through Keap Pay

Keap Pay will be able to accept the following payment methods:

- Credit cards

- ACH (Coming in ‘24)

- ApplePay (Coming in ‘24)

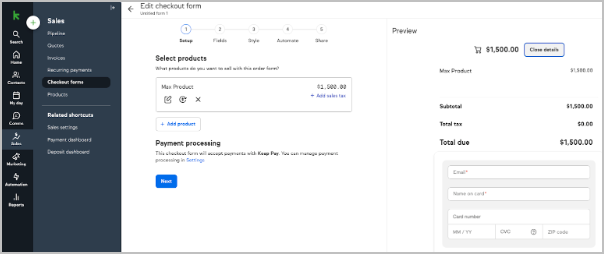

Once you are active with Keap Pay you can accept payment through any of Keap’s E-commerce features (Order Forms, Shopping Cart, Invoices, Manual Payments)

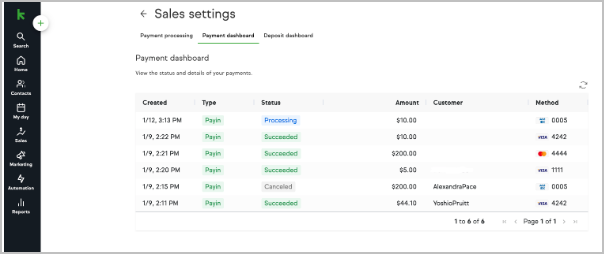

Payment Dashboard

Keap Pay’s Payment Dashboard will allow you to see the status of your incoming payments in real time along with transaction or deposit IDs if support help is required.

Navigating the payments report

To Access:

- Navigate to Sales

- Under Related Shortcuts you will see Payment Dashboard. You can also access via E-commerce Setup and Payment Processing.

Items on the Dashboard:

- Date the Payment was created

- Type of Transaction - Types of Transactions

- Status - Status and Meaning

- Payment Amount

- Customer Name

- Payment Method (Credit Card type with Last 4, ACH, Apple Pay)

Finding a Specific Payment

To Narrow down to a specific Payment in the Dashboard the best way is to:

- Start by clicking “Customer” at the top of the dashboard and searching by their name

- Then you can narrow down by date created or by amount

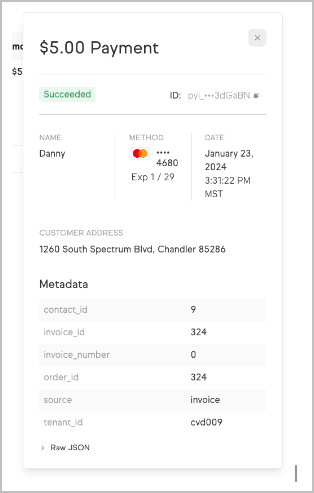

Clicked into a Payment Details

Handling a Chargeback

When a chargeback is initiated on a payment you will see the status on the Payment Dashboard change for that payment and you will see the amount of that payment plus your chargeback fee taken out of your account and will show on the Deposit dashboard.

You will have two options to handle the chargeback:

- Agree - To agree you do not have do anything just leave it as is

- Dispute - To Dispute you will choose Dispute and then provide the needed evidence both written and any screenshots.

If you win, the dispute will change to “won” and the total amount of the payment will be returned (chargeback fees are non refundable). If you lose, the dispute will change to “lost” and no additional funds will be taken.

Getting Support

When on the Payment Dashboard you can click on any individual Payment and see additional details on the payment including the Payment ID. This ID is critical for our Support team when reaching out for us to narrow down which payment you are looking for help on. Example: pyi_2ajcJnr5FqywwyptamlESa4Pp2w

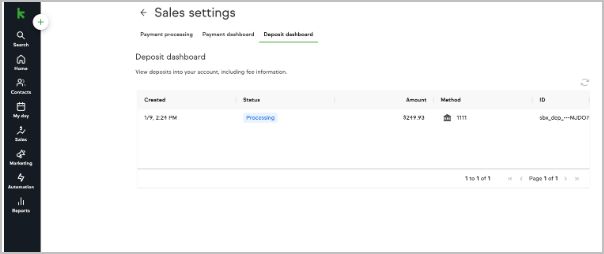

Deposit Dashboard

Keap Pay’s Deposit Dashboard will allow you to see your Deposits in real time, What payments made up those Deposits, Export a CSV of Payments that made a Deposit, and needed IDs if support help is required.

Items on the Dashboard:

- Date the Deposit was created

- Status of Deposit

- Deposit Amount

- Method of Deposit (What Bank account was it sent to)

- Deposit ID

To Access:

- Navigate to Sales

- Under Related Shortcuts you will see Deposit Dashboard. You can also access via E-commerce Setup and Payment Processing.

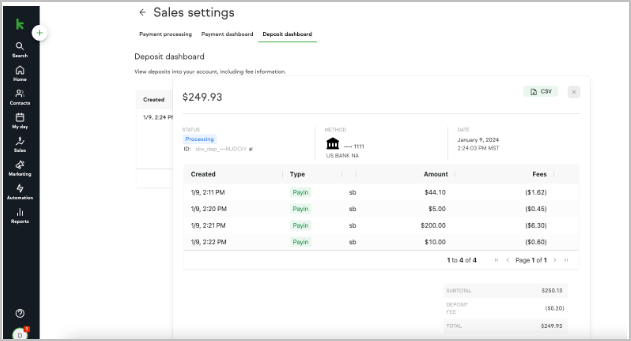

Seeing What Payments Made Up a Deposit

When on the Deposit Dashboard you can click on any individual Deposit and a pop up will appear showing a list of each payment that made up that deposit. This list will show the following about each payment in that deposit

- Date the Payment was created

- Type of Transaction

- Payment ID

- Payment Amount

- Fees

- Net after Fees

*NOTE the total deposited will also include any other fees (Deposit, Chargeback, Updater etc) .

Exporting a CSV

When on the Deposit Dashboard you can click on any individual Deposit and in the Top right hand corner of the pop up will be a CSV Button by clicking this you can download a copy of the payments in that deposit with all above information and any additional fees.

Getting Support

When on the Deposit Dashboard you will see a Deposit ID. This ID is critical for our Support team when reaching out for us to narrow down which payment you are looking for help on. Example: pyi_2ajcJnr5FqywwyptamlESa4Pp2w

Keap Pay Details

Sticker Pricing

| Card Processing Fees - Applies to all credit card payments and refunds | |

| Card Transaction Volume Fee | 2.99% |

| Card Transaction Per item Fee | $0.30 |

| ACH Processing Fees - Applies to All ACH payments and refunds | |

| ACH Volume Rate | 1% up to $10 |

| ACH Transaction Per Item Fee | $0.30 |

| Payout Fees | |

| Standard ACH Payout (Per batch) | $0.50 |

| Additional Fees | |

| Account Updater | $0.50 |

| Card/ ACH Refund | $0.30 |

| ACH Return | $15.00 |

| Chargeback (Card or ACH Dispute) | $15.00 |

Payment Types

- Payin - Your client made a payment with you

- Refund - You have initiated a partial or full refund

- Adjustment - You have adjusted the total owed

- Chargeback - This Payment has had a Chargeback initiated on it

Payment Statuses

- Processing - Payment was successful and is currently processing

- Succeeded - Payment has completed processing and is available for deposit

- Failed - Payment Failed to Process (Refusal codes below)

- In Review - This payment has been flagged for risk review

- Canceled - The payment was canceled and no funds will move

- Presenting - Space between card being shown and actually processing

Failed Payment Refusal Codes

| CODE | DESCRIPTION | Recommended Cardholder Action |

| DECLINED | Declined. | Issuer Decline - Call Bank or Try Alternative Payment Method |

| DO_NOT_HONOR | Do not honor. | Issuer Decline - Call Bank or Try Alternative Payment Method |

| EXPIRED_CARD | Expired card. | Issuer Decline - Call Bank or Try Alternative Payment Method |

| FRAUDULENT_CARD | Fraudulent card. | Issuer Decline - Call Bank or Try Alternative Payment Method |

| INCORRECT_PAYMENT_INFORMATION | Incorrect payment information. | Review Billing and Card Information |

| INSUFFICIENT_FUNDS | Insufficient funds. | Issuer Decline - Call Bank or Try Alternative Payment Method |

| INVALID_CARD_SECURITY_CODE | Invalid card security code. | Review Billing and Card Information |

| INVALID_EXPIRATION_DATE | Invalid expiration date. | Review Billing and Card Information |

| INVALID_PIN | Invalid PIN. | Review Billing and Card Information |

| LOST_CARD | Lost card. | Issuer Decline - Call Bank or Try Alternative Payment Method |

| NO_CARD_NUMBER_ON_FILE_WITH_ISSUER | No card number on file with issuer. | Review Billing and Card Information |

| NO_SUCH_CARD_ISSUER | No such card issuer. | Review Billing and Card Information |

| OVER_LIMIT | Over limit. | Issuer Decline - Call Bank |

| PROCESSING_ERROR | Processing error. | Re-Try Payment |

| STOLEN_CARD | Stolen card. | Issuer Decline - Call Bank or Try Alternative Payment Method |

| UNEXPECTED_PAYIN_TOKEN | Unexpected payin token. | Re-Try Payment |

| UNSUPPORTED_CARD_TYPE | Unsupported card type. | Try Alternative Payment Method |

Keap Pay FAQ

When will my payments show up in my bank account?

We offer Transaction plus 1 business day funding for all Card Transactions and Transaction plus 4 business days funding for all ACH transactions. This will be impacted by bank holidays and weekends.

| Card Transactions | ACH Transactions | ||

| Day of Transaction | Day of Deposit | Day of Transaction | Day or Deposit |

| Monday | Wednesday | Monday | The following Monday |

| Tuesday | Thursday | Tuesday | The following Tuesday |

| Wednesday | Friday | Wednesday | The following Wednesday |

| Thursday | Monday | Thursday | The following Thursday |

| Friday | Tuesday | Friday | The following Friday |

| Saturday | Tuesday | Saturday | The following Friday |

| Sunday | Tuesday | Sunday | The following Friday |

| Monday with Bank Holiday on Tuesday | Thursday | Monday with Bank Holiday on Tuesday | The following Tuesday |

Are there any businesses that are prohibited from using Keap Pay?

Yes we do have some business types that we prohibit from using Keap Pay. Many of these business types are also against our AUP. Here is a comprehensive list of our prohibited businesses for Keap Pay. If you see your business type on this list but you are allowed to send email via Keap please contact support to see if we can make an exception.

I want to use Keap Pay but I’m looking for a lower rate than what's posted

With the embedded Keap Pay solution you gain significant value from the insights and automation making it difficult to compare to your current provider, however We want you to get the most value possible with Keap so we are able to offer a rate review if you are transacting above $100K a month on average. If you would like a review please contact support or your CSM.

I’m currently using a different processor with Keap can I try Keap Pay out before switching?

Yes! By having Keap you are already 90% onboarded all you need to do is click connect and provide information about your business and ownership and will be able to try it out!

I filled out my Onboarding Form but I’m still not active yet and heard nothing.

It can take up to 72 business hours for an onboarding to complete. If it has already been that time please contact support.

I had a transaction but its not showing on the Payment Dashboard.

The most common reason for this problem is that the transaction was made with a processor that is not Keap Pay. So we suggest looking at the order and seeing what payment processor was used. If it was Keap Pay and it has been longer than 1 hour contact support.

How do I process a refund?

We will soon be adding the ability to refund right within the Payment Detail on the Payment Dashboard. For now please refer to the current refunding process discussed in this Help Center Article.

I won a Chargeback but the total returned wasn’t correct.

First validate that the amount missing is more than your chargeback fee. That fee is non refundable even when a chargeback is won. If it is still incorrect please contact support.

I see I got a Payment but I’m not seeing it in my Deposit Report

First make sure the payment is in “succeed” status. If it was under 24 business hours for a credit card or up to 4 business days for ACH please give it that time for the payment to complete. If its been past that time and its showing the right status, contact support.

I see I got a Deposit but its not in my bank account.

First make sure the Deposit is in “succeed” status. If it was under 24 business hours please give it that time for the status to change and the money to show. Then connect with your bank to see if there is any block on their end. If there is still not showing contact support.

How do I update my Information about my Business?

If there is a change in your business ownership, name, address, or tax IDs please reach out to Support right away and we can get those updates done for you.

How do I update my Bank Account for Deposits?

If you need to update your bank account for deposits please reach out to Support.